How do I read the FrontLobby account on my Credit Report?

Depending on the Credit Bureau, the rental data reported through FrontLobby appears as an open account or a collections line on a credit report.

Rental data that has been reported through FrontLobby will appear as an open tradeline account or a collection account on a credit report. How it appears depends on the payment status and the Credit Bureaus.

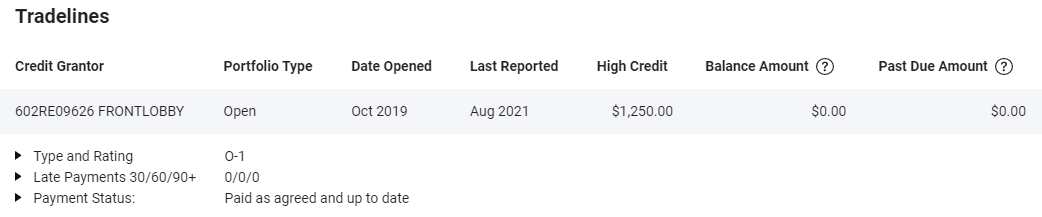

The Credit Bureaus have requested that Housing Providers report rent in a specific format so it may appear on a consumers credit file. The major data points are explained below to help you interpret the credit report.

Credit Grantor - The name of the creditor will be FrontLobby, however some legacy tradelines may still say LCB Services.

Portfolio Type - O (Open).

Payment Status - Indicates whether the account is "paid as agreed and up to date", or if there are past due payments (i.e. 30/60/90+ days past due).

Date Opened - Indicates the lease start date.

High Credit - Indicates the monthly rental amount (i.e. $1,250 if rent is $1,250/month).

Balance - Indicates the amount owed as of the last reported date.

Past Due Amount - Indicates the dollar value of the debt that is owed. A $0 past due amount indicates rent is paid and no debt is owed. A $500 past due amount indicates that at the end of that month, a renter owed $500.

Debts reported to Equifax Canada without the consent of the Tenant will appear as a collection on the credit file with the housing providers name as the creditor.